Budget 15: What will be in the box?

In the second part of our Budget preview, Paul Dale looks at some of measures likely to emerge from the Chancellor’s budget box tomorrow.

Bank levy

The levy has increased steadily since being introduced by George Osborne in 2010. Last year it raised £2.2 billion for the Treasury. Osborne would struggle to justify removing the levy whilst the country still fights to reduce the deficit, and the Conservative party said it would remain in place in their pre-election manifesto.

There have been some loud calls for the levy to be scrapped. Before the election, HSBC threatened to move its operations out of the UK to avoid the tax whilst Standard Chartered has also been critical.

BBC

Following weekend speculation and comments from the Chancellor, the Culture Secretary was yesterday forced to reveal the new licence fee deal struck in just the last seven days with the BBC which includes the Corporation taking on funding the free licence fee or the over-75s.

Aggressive tax avoidance

A major part of the Government’s plan to tackle the deficit is to reduce tax evasion and aggressive tax avoidance to raise £5 billion. The Department for Work and Pensions, despite facing cuts, may be given further support in this area as it targets big companies and individuals of high net worth.

It is likely that greater emphasis will be placed on the prosecution of individuals and firms that advise and advertise avoidance schemes. However, it is thought unlikely the Government will bring forward any legislation.

Inheritance tax

In their General Election manifesto, the Conservatives committed to increasing the inheritance tax threshold for married couples to £1 million. They also gave detail around the funding of the measure, saying it would be paid for by a reduction on tax relief on pension contributions for those earning above £150,000. Pre budget leaks and interviews have all but confirmed the Chancellor will bring in the changes he first announced before the great recession as shadow chancellor.

Income tax

There has been plenty of speculation that the Government is considering reducing the top rate of income tax rate to 40p, a move that would bring plenty of cheers from Tory MPs and reinforce Mr Osborne’s right wing credentials as a possible future party leader. The move would be a bold one, given that Osborne would then be forced to maintain this rate for the full term of the Parliament following commitments in the Queen’s Speech to enact legislation preventing any rise in income tax.

The Chancellor, through the Conservative Party’s manifesto, has pledged to increase the personal allowance to £12,500 and the higher rate threshold to £50,000 over the lifetime of this Parliament. The personal allowance will be set at a level that at least ensures that those working 30 hours a week on the national minimum wage are not subject to income tax.

Pensions

The Chancellor is likely to announce another restriction of the pension tax relief with the lifetime allowance reduced to £1 million and the tapering of pension relief for those earning over £150,000, resulting in a level of £10,000 annual allowance for those earning over £210,000. The funds that this generates have been earmarked to cover the £175,000 transferable main residence allowance.

Business rates

In the last Budget we heard of the Government’s intention to fundamentally review business rates. The Government has stated that any new system should raise the same amount of money, something that severely constrains reform. Mr Osborne may give further details of what is planned, or given the past reluctance of governments to tackle this issue, he may not.

Data sharing

The chancellor may consider encouraging greater data sharing capabilities across the financial services sector. This would tie into the agenda of digitalising more services, embracing financial technology and making switching accounts easier for the consumer.

Annual Investment Allowance

In March 2015 the Chancellor set the Annual Investment Allowance (AIA) at £500,000 until 1 January 2016. This completed a move which had seen the amount steadily rise, but the looming deadline may mean the chancellor is inclined to put something permanent in place. As this remains quite a costly policy to benefit business, it may be that the AIA is reduced to £250,000.

Support for small businesses

We could see the expansion of enterprise zones to include more areas, as well as an exemption for small properties from business rates. Following the recent consultation, the Chancellor could also announce steps to improve access to R&D credits for small businesses.

Fuel Duty

The Chancellor was persuaded by colleagues to freeze fuel duty in successive budgets in an attempt to lure working class voters. There are fears now, with the election behind him, Mr Osborne may increase duty, which has fallen in real terms, and bring it back in line with inflation.

Police spending

The Conservative Government is committed to extending the programme of cuts to police spending. In her address to the Police Federation conference in May 2015, Home Secretary Theresa May stated: “There is no ducking the fact that police spending will have to come down again”. May said that the next round of savings would mean that police reform would have to go much deeper than “shaving a bit of excess off here” or reducing bureaucracy. The Government may well use the Budget to set out this programme of cuts in more detail.

Legal aid

In his recent speech to the Legatum Institute on a ‘two nation justice system’, Justice Secretary Michael Gove said that leading law firms could be made to contribute to legal aid in the future. Gove did not spell out how such contributions would be extracted but indicated that legislation could be involved. The Budget may provide the chancellor an opportunity to flesh out these plans.

Defence

The defence budget is not ring fenced and the Ministry of Defence is expected to make its contribution to the Chancellor’s deficit reduction target. The Government has already announced that the MOD will be making £500 million worth of savings but emphasised the UK would still be meeting its NATO target of spending two per cent of GDP on defence this year.

In their election manifesto, the Conservatives committed to increase the defence equipment budget by one per cent ahead of inflation, modernise Trident and deliver a triple lock that would guarantee the size, the shape and the power of the Armed Forces beyond the spending review.

Public health

George Osborne has pledged to make no cuts to NHS services, but he will outline plans to reduce the public health budget (non-NHS) by £200 million for local councils. This will mean the £2.87 billion originally earmarked for councils for public health spending in 2015-16 will be cut by 7.4 per cent.

It is claimed that these cuts will not affect frontline services, and that the £200 million figure is based on projected local authority underspends. Among the services funded by councils through their public health budgets are: obesity services; school nursing; drug and substance misuse programmes; smoking cessation services; and sexual health schemes.

Local government

With the local government finance settlement agreed for 2015-16, we’re not expecting this to be reopened however further cuts may be announced for future years in the Autumn Statement.

Higher education

Since the announcement on 4 June about the Department for Business, Innovation and Skills (BIS) having to find £450 million in cuts, there has been a widespread belief across the higher and further education sectors that they will be bear the biggest brunt of such cuts, especially given the ring-fencing of the science budget. Given the poor reaction and result of the 2014 student loan sale programme, it is unlikely that a similar policy would be introduced for 2015-16.

Further education

Along with BIS’ £450 million budget cuts, the Department for Education is now required to find the same amount in savings for 2015-16. Given the Conservatives’ promise to ring fence spending on schools from ages four to 16, there is a lot of financial pressure on post-16 education including for sixth forms and further education colleges.

The Skills Funding Agency (SFA) adult skills budget was just over £2 billion for 2015-16 which has to cover apprenticeships and other forms of adult learning; it’s likely to be the latter which suffers most cuts to the SFA budget given the Government’s prioritisation and protection of apprenticeships. However, with the looming cuts, the FE sector’s ability to deliver the three million apprenticeships starts promised by the Government is coming into question as well given the SFA’s decision to delay the decision on in-year growth payments until after the budget.

Similar Articles

Greater Birmingham skills coaching scheme takes 8,000 people off the dole 1

More than 8,000 unemployed people in the Greater Birmingham area have been found work in

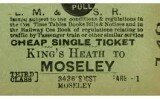

Re-opening Moseley-Camp Hill railway a job for WMCA, say Liberal Democrats 6

Liberal Democrats are urging the new West Midlands Combined Authority to show leadership by heading

The local elections in Greater Birmingham – minus Birmingham 5

Chris Game, from the University of Birmingham's Institute of Local Government Studies, fills in the gaps

All systems go for combined authority to transform West Midlands’ economy 17

The West Midlands Combined Authority is on course to start operating in a little over

Midlands Engine steps on the gas with £180m energy research fund 6

A ground-breaking £180 million Government-backed fund to drive forward energy research, innovation and skills across