Budget16: Osborne sweetens Budget pill with sugar tax, fuel and alcohol duty frozen

George Osborne unveiled a surprise tax on sugary drinks and confirmed that every state school in the country is to be converted into an academy as he promised to “put the next generation first” in his 2016 Budget.

The Chancellor announced the measure to tackle child obesity alongside a new ‘lifetime ISA’ and a further reduction in corporation tax to 17 per cent.

The sugar tax will be imposed in 2018 and the revenue raised – an estimated £520 million a year – will be used to fund sport in schools.

Mr Osborne told MPs:

I am not prepared to look back at my time here in this Parliament, doing this job and say to my children’s generation ‘I’m sorry. We knew there was a problem with sugary drinks. We knew it caused disease. But we ducked the difficult decisions and we did nothing.’

He confounded his critics by announcing, despite falling oil prices, that fuel duty will be frozen for the sixth year running. He also froze duty on beer, cider and whisky.

As expected, he confirmed that the tax-free allowance will be increased to £11,500 from next year. He also announced abolition of class two national insurance payments for self-employed people from 2018.

Despite slowing growth rates Mr Osborne insisted he was presiding over a “low tax enterprise Britain” and his speech was peppered with remarks about “putting stability first” and the dangers posed by turbulent financial markets.

Mr Osborne will miss another of his fiscal targets, that the debt-to-GDP ratio will fall every year, after the Office for Budget Responsibility downgraded growth forecasts.

He is however still on track to reach a budget surplus by 2019/20.

Other measures the Chancellor announced included new measures to tackle tax avoidance and a range of new infrastructure projects including confirmation that HS3 between Leeds and Manchester will go ahead as well as £161 million to accelerate the transformation of the M62, and £75 million to improve other road links across the North including the A66 and A69.

Mr Osborne made several announcements about devolution including a decision to hand powers over the criminal justice system to Greater Manchester.

He confirmed approval for new combined authorities covering East Anglia and Lincolnshire, both to be headed up by an elected Mayor as well as a new West of England mayoral authority.

Speculation that the Chancellor would announce a £400 million investment fund for the Midlands Engine did not materialise. However, a number of measures were announced in supporting documents including a new enterprise zone in Brierley Hill as well as an agreement with local enterprise partnerships and the British Business Bank to invest £250m small businesses in the Midlands.

A total of £16 million will be handed to the region’s aerospace industry along with £14 million to fund STEAMhouse, a new innovation centre in Birmingham’s Digbeth creative quarter.

The Chancellor’s support for the Midlands was welcomed by Greater Birmingham and Solihull LEP chair Andy Street, who said the £250 million investment fund amounted to a vote of confidence in the region. Mr Street added:

The need to strengthen the skills base around Science, Technology, Engineering, Arts and Maths (STEAM) of the GBSLEP area is at the heart of the our Strategy for Growth. STEAMHouse is one of the key projects which will help achieve this and so the announcement of £14m in the Budget to help support its establishment by Birmingham City University is hugely welcomed.

Headline announcements from Budget 2016:

Taxation

Tax free personal allowance to rise from next year to £11,500.

Higher rate to increase to £45,000.

Corporation tax to be reduced to 17 per cent by 2020.

Business rate relief raised to £15,000 permanently.

Capital Gains Tax cut from 28 per cent to 20 per cent – from 18 per cent to 10 per cent for basic rate taxpayers.

Two new tax free allowances for trading and profiting income, worth £1,000 each for micro-entrepreneurs.

Beer and cider duty frozen, along with whiskey.

Duty on all other alcohols to rise as planned.

Tobacco duty to rise from 2 per cent from tonight.

Abolition of class two National Insurance contributions to help the self-employed.

Financial Services and Pensions

ISA limit increased from £15,000 to £20,000

A new lifetime ISA for the under-40s from April 2017. £4000 will be able to be saved per year and the Government will contribute £1 for every £4 saved. Help-To-Buy ISAs already taken out will be able to be rolled in.

Increase in the insurance premium tax by 0.5 per cent with all money raised (£700m) going to flood defence spending.

Education and Skills

By 2020 all primary and secondary schools in England will be academies or in the process of becoming one.

Education secretary to publish a White Paper on improvements to the education system on March 17 2016.

All young people will be taught maths to age 18.

Health, Social Care and Welfare

A sugar levy on ‘excessively’ sugary drinks, with fruit based or milk based drinks excluded. Income from this will be used to increase funding for sport.

Extension of the use of funds raised by the ‘tampon tax’ to support further charities.

Confirmed real terms increase to the disability budget, but changes to target those who need support most, in line with last week’s DWP announcements.

Local Government and Public Sector

Opening negotiations on new city deals with Edinburgh and Swansea.

£1bn each in investment for East Anglia Combined Authority and West of England Authority.

Devolution of business rates to the Greater London Authority from next April.

New powers and funding for Lincolnshire.

Lord Heseltine will lead a Thames Estuary Growth Commission and will report next year.

Housing

£115m to tackle homelessness and rough sleeping.

Commercial stamp duty to have a zero rate band on purchases up to £150,000; a two per cent rate on the next £100,000; and a five per cent top rate above £250,000.

Extending stamp duty changes on additional properties to large investors, using receipts to support community housing trusts, including £20m to help young families onto the housing ladder in the South West of England.

Transport and Infrastructure

£300m in transport investment, and go ahead confirmed for Crossrail 2 and HS3.

Investment in a four lane M62, a new tunnel road and upgrades for A66 and A69.

Driverless cars will be trialled on motorways.

Halving the price of tolls on the Severn Crossings.

Fuel duty frozen.

Energy and Environment

Abolition of the carbon reduction commitment.

Climate change levy will rise from 2019.

Cutting supplementary charge on oil and gas to from 20 to 10 per cent.

Effectively abolishing petroleum tax.

£730m for further contract for difference auctions for new renewable technologies

Culture, Media and Sport

£1.5bn in funding for school sport and arts clubs to help schools open for an extra hour per day.

Tax breaks for museums who take their exhibitions on tour.

Home Affairs and Immigration

Transfer of criminal justice powers to Greater Manchester Combined Authority.

Similar Articles

Time running out to get a slice of £9m Greater Birmingham housing fund 3

Developers have just one week to stake a claim for a share of a £9 million

Greater Birmingham skills coaching scheme takes 8,000 people off the dole 1

More than 8,000 unemployed people in the Greater Birmingham area have been found work in

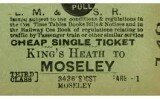

Re-opening Moseley-Camp Hill railway a job for WMCA, say Liberal Democrats 6

Liberal Democrats are urging the new West Midlands Combined Authority to show leadership by heading

The local elections in Greater Birmingham – minus Birmingham 5

Chris Game, from the University of Birmingham's Institute of Local Government Studies, fills in the gaps

All systems go for combined authority to transform West Midlands’ economy 17

The West Midlands Combined Authority is on course to start operating in a little over