How devolution could offset Birmingham council’s ‘drastic’ spending cuts

Cities like Birmingham could reap huge financial benefits and offset the impact of council spending cuts if the Government quickens the pace on fiscal devolution, new research has claimed.

The thinktank says the devolution of business rates is a step in the right direction and will give cities more control over a growing tax base and more incentives to support and attract inward investment to the area.

However, the report – Beyond business rates, incentivising cities to grow – warns: “There remains a risk that the devolution of business rates alone – particularly in its current form – will not provide a strong enough growth incentive to generate significant additional funding for UK cities”.

Centre for Cities is proposing a package of reforms which would allow councils to keep all of the stamp duty generated from the sale of homes in their area, some £10 billion a year for England.

This, alongside the £23 billion of business rate income, would reduce the risk of cities being dependent upon just one devolved tax stream by giving them control over the equivalent of 37 per cent of local spend compared to just 19 per cent in the current system of funding.

While this would still represent a relatively small proportion of local government revenue being drawn from local taxes compared to other countries – the figure is 48 per cent across municipalities in France, and 64 per cent in New York – it could make a big difference in Birmingham where the city council is intent on increasing the rate of housebuilding.

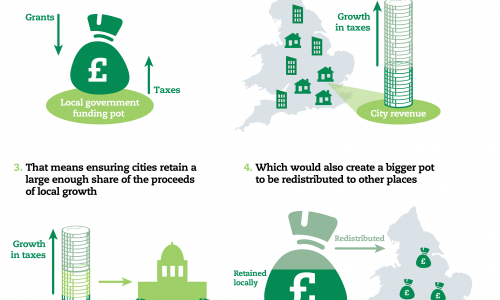

The report sets out a four-point justification for increased fiscal devolution:

- With Government grants falling the only way to increase funding for local areas is through growing the economy.

- To do so cities need incentives to support business growth and build homes, which will increase local tax revenue.

- That means ensuring cities retain a large enough share of the proceeds of local growth.

- Which would also create a bigger pot to be redistributed to other places where economic growth is not so strong.

The Government is also urged to allow councils in city regions to pool income from business rates and stamp duty, creating huge investment pots to grow the economy and build more homes.

The Centre for Cities proposals are in line with ideas being promoted by John Clancy, the leader of Birmingham city council, who is keen to explore new ways of raising funding to offset the £250 million in spending cuts expected over the next four years. He has referred to the savings the council has to make as “drastic”.

Cllr Clancy told the Birmingham Independent Improvement Panel this week that income from business rates retention could provide a financial lifeline offsetting the impact of spending cuts and helping the council to grow the economy and create jobs.

Cllr Clancy said:

It is economic development and sustainable business growth that will impact on the prosperity of this city. We have to have hope, we have to see there are ways forward for this city working together that will bring economic growth and will mitigate the tough decisions we are making.

The Centre for Cities report sets out the rationale for fiscal devolution:

“UK cities currently lack the ability and incentives to prioritise spending and overcome barriers to local economic growth. Compared to their international counterparts, they have too few financial incentives to take the often difficult decisions required to boost growth, or innovate to deliver more effective and efficient public services.

“But the funding landscape is changing. The move away from centrally redistributed grants to local government, towards places being more dependent for funding on the business rate revenues they collect locally, provides an opportunity to improve how the system works.

“This process of giving places more responsibility to raise and retain their own funding will provide UK cities with sharper incentives to back investment in the things that can really make a difference to their local economy – building new homes, investing in the local skills base, or delivering new infrastructure to better connect people to jobs, and businesses to customers.

“The recent central funding cuts for local government have reduced the resources available to them – with estimates that the total cuts, based on the latest Spending Review, will have been 56 per cent between 2010 and 2020.

“Many local authorities have warned that by 2016 they will no longer be able to cover basic services. The increasing cost of social care, driven by an ageing population and population growth, is of particular concern. It is estimated that by 2020 councils will need to find an additional £4.3 billion, or 2.5 per cent, increase in current local government spend, just to manage care at current levels.

“Given the cuts that have already been made and the commitment from the Government to continue to reduce public spending and reduce the deficit, this shortfall (and others) is unlikely to be plugged by central government grants.”

Similar Articles

Tourist charge shouldn’t depend on the Games 0

Did you notice the wording of the Birmingham Post’s front-page Commonwealth Games story last week

A week? A day is a long time in politics 0

From City of Culture to the Commonwealth Games (with “sufficient progress” in the Brexit negotiations

Council CEO: Baxendale for Birmingham 3

Dawn Baxendale, currently chief executive of Southampton City Council, will be appointed as chief executive

An Optimism of Mayors 0

What is the collective noun for Mayors, you might be wondering? OK, you probably weren't.

Commonwealth Games finishing line extended…again 0

If the race to host the Commonwealth Games was itself a sporting event, one team